“This is all happening right now! Let me check my email about this…” says Frances Seymour, World Resources Institute’s Distinguished Fellow and one of the U.S. State Department’s Science Envoys. Seymour is world-renowned for her tropical forest research and has her finger on the pulse of the continuous changes and updates in the voluntary carbon market for tropical forest carbon credits. As a Yale Forest Forum instructor for the fall 2022 and spring 2023 speaker series, Seymour ended the fall YFF speaker series and kicked off the spring YFF speaker series with recorded talks on the current debates in carbon markets, and she shares some of those major updates in this article.

In December 2022, Guyana became the first country to issue jurisdictional carbon credits through the Architecture for REDD+ Transactions (ART), meaning that these credits are “specifically designed for the voluntary and compliance carbon markets for successfully preventing forest loss and degradation,” according to ART. During the YFF spring speaker series, this sparked conversations about how this rewards countries like Guyana, which are considered high forest, low deforestation (HFLD), for maintaining high forest carbon stocks.

Guyana is considered a high forest, low deforestation country, and is using a special crediting approach allowed for such jurisdictions to issue credits under the ART TREES standard. Photo: Saül, Guyana; Ronan Liétar; Wikimedia Commons.

Seymour serves as ART’s board chair and remarked in ART’s press release: “Guyana is the first to complete the ART process for generating high-integrity, Paris Agreement-aligned carbon credits that will allow the country to access market-based finance to continue to implement forest stewardship strategies. ART, other governments, and important stakeholder groups, especially Indigenous Peoples and local communities, around the world can now build on Guyana’s experience to accelerate progress towards meeting global forest and climate goals in ways that ensure environmental and social integrity.” ART has issued 33.47 million ART-TREES credits to the country, and Guyana has already sold one third of them on the voluntary carbon market in a multi-year deal for at least $750 million with 15% of funds allocated to Indigenous communities, though not all are confident that Indigenous peoples will benefit equitably. Mary Grady, executive director of the ART Secretariat, spoke to YFF on ART’s architecture to ensure social and environmental integrity on March 9, and the video is available to view.

As the spring speaker series carried on, the Integrity Council on Voluntary Carbon Markets (ICVCM) disclosed their framework for assessing carbon crediting programs. Launched on March 29, 2023, the Core Carbon Principles and Program-level Assessment Framework seeks to create the global mechanism and benchmark for rigorous disclosure and sustainable development results for high integrity carbon credits. The goal is to “set out fundamental principles for high-quality credits that create real, verifiable climate impact, based on the latest science and best practice.” Seymour describes this as an effort to be a meta-initiative amongst all of the various voluntary accounting initiatives. This framework launched a YFF conversation about whether or not HFLD credits will be incorporated and the pros and cons associated with that.

ICVCM divides the Core Carbon Principles into three main groupings, governance, emissions impact, and sustainable development, in an effort to create a global benchmark for high-integrity carbon credits.

Daniel Ortega Pacheco, ICVCM expert panel co-chair, joined the YFF as a guest speaker on April 20 to discuss ICVCM’s role in REDD+ in global carbon market initiatives. To hear directly from ICVCM, the video of his talk is available.

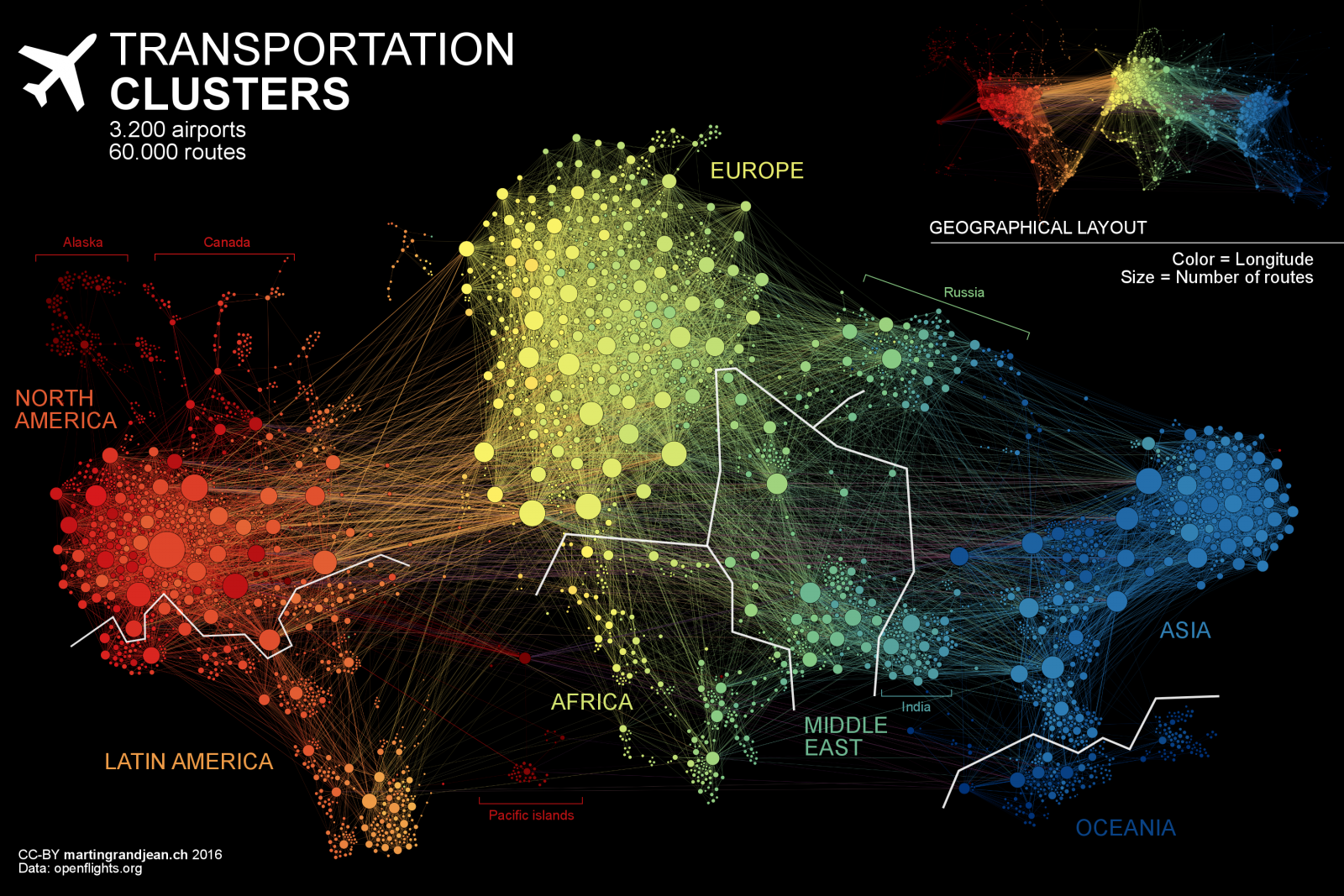

Relatedly, the U.N. International Civil Aviation Organization (ICAO) also assesses the quality of carbon credits, Seymour explains. ICAO has been in the news for seeking to reduce carbon emissions in the aviation sector through the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). While this crediting program will be voluntary from 2024-2026, it will become mandatory in 2027. YFF speaker Molly Peters-Stanley, negotiator at the U.S. Department of State, presented on the multilateral decisions and carbon market developments that led to CORSIA. The video of Peter-Stanley’s talk is also available.

This graphic illustrates the extent of air travel by region around the globe, with the highest intensity in Europe and North America, according to 2016 data.

Seymour explains there is also an ongoing effort by a group of supplier country governments associated with the Coalition for Rainforest Nations, which was integral in getting REDD+ integrated into the UNFCCC negotiations in 2005. These countries advocate that country “sovereign units” based on national reporting of emissions reductions under the Paris Agreement are sufficient for trading in carbon markets and that there is no need for independent verification outside of the Agreement. However, neither aviation nor shipping emissions, which cross international boundaries, are covered by the Paris Agreement.

The very last session of the spring speaker series was a panel discussion on three major crediting approaches to forest carbon markets: sovereign credits, jurisdictional credits, and individual projects. Peter Boyd, Yale School of the Environment lecturer and YFF instructor, hosted this conversation amongst Emilio Sempris, regional director for Latin America and Caribbean at the Coalition for Rainforest Nations, Rocio Sanz Cortes, head of origination at Emergent, and Jo Anderson, director of finance and sales at Carbon Tanzania. The full discussion can be watched here.

Field research and stakeholder engagement are at the core of determining the basis for high-quality carbon credits. Photo: ©2011CIAT/NeilPalmer.

Boyd says it’s not surprising how much movement has been made in the past several months considering how many passionate and intelligent people are wrestling with difficult issues related to carbon credits. He sees this as evident throughout the series. Boyd believes clear communication to the buyer is needed now more than ever and hopes that this series has brought clarity. In a commentary, Boyd and Ortega-Pacheco call for peace in arguments around the validity of various crediting mechanisms. They write: “We believe all three approaches have inherent validity and climate benefit, but their public arguments are detrimentally affecting buy-side confidence in the market.” Instead of labeling different approaches as “wrong,” Boyd suggests buyers build portfolios of carbon credits from each of the three market mechanisms.

Boyd sees Yale continuing to play a role in bringing stakeholders together in seminar series and in convenings. As a YFF instructor and YSE lecturer, Boyd hopes that attendees and students are inspired to work in the carbon credit market.

Seymour sees the conversations evolving to find a sweet spot for standard setting—neither too high nor too low—that will make it attractive for tropical countries to join the market. YFF instructors Sara Kuebbing, research director of the Yale Applied Science Synthesis Program, and Luke Sanford, YSE assistant professor of environmental policy and governance, are in the process of organizing a workshop through the Yale Center for Natural Carbon Capture to dive deeper into the details on one such topic – the baselines that underlie carbon accounting.

Sanford describes why the series has inspired this new research program on how to effectively measure additionality of forest carbon projects and programs. “I had prior research into how to better use satellite data to conduct environmental impact evaluation, and this series has shown me that the problems I have been grappling with in that area are some of the core problems with forest carbon markets,” says Sanford. In collaboration with Kuebbing and supported through a Child’s Family Research Grant, the two will build a library of forest carbon protocols and qualitatively assess similarities and differences between protocols, including rules and tests for additionality and baselines.

“Cataloging the current standards that exist for forest carbon credits will enable us to highlight the range of approaches used for determining baselines and additionality, where these methods could be improved, and increase transparency in the voluntary carbon market space,” says Kuebbing. Sanford will then transfer his research methods to evaluate projects under the California Air Resources Board compliance market, voluntary projects under REDD+, and jurisdictional-scale REDD+ programs. Their proposed research has earned both the Child’s and Yale Planetary Solutions Projects grants, with two more applications outstanding.

A view from the canopy of a rainforest in Guyana. Photo: Avi Alpert, Creative Commons.

If we zoom out to 30,000 feet, beyond our speaker series, it’s important to remember that these debates are taking place within a broader international examination of whether any tradable carbon credits should be generated from forests whatsoever. It’s also a reminder to keep an eye on the fact that society also needs to dramatically reduces emissions from fossil fuels to address climate change and protect the world’s forests.

More information on the YFF carbon-related series can be found here:

Motivations for YFF’s Series: How Can the Voluntary Carbon Market Make a Meaningful Contribution to Protecting Tropical Forests? Spring 2023 series.

Series Overview: How Can the Voluntary Carbon Market Make a Meaningful Contribution to Protecting Tropical Forests? Spring 2023 series.

Motivations for YFF’s “What Makes a High-Quality Forest Carbon Credit?” Fall 2022 series.

Series Overview: What Makes a High-Quality Forest Carbon Credit? Fall 2022 series.